( Qasim Abbas, FCA )

Mississauga, Ontario

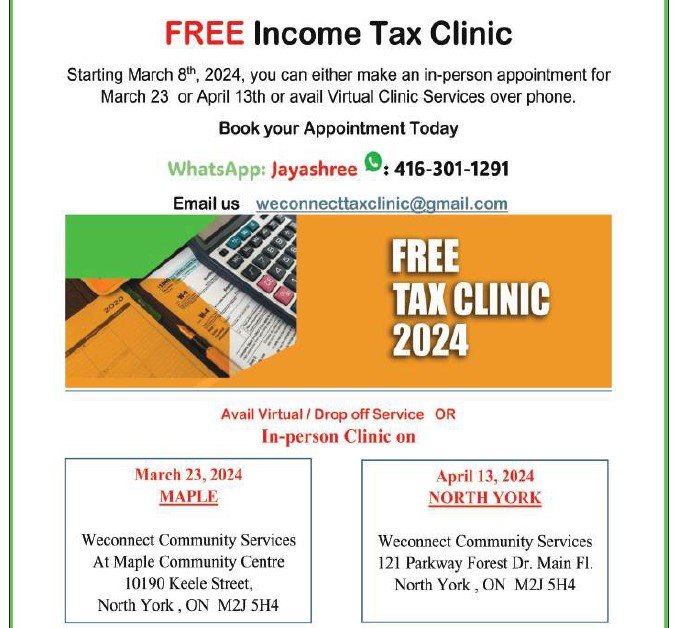

In Canada, the last date for filing year 2023 Income Tax Return is 30 April 2024. For those, who face difficulty in completing their Income Tax Returns, Canada Revenue Agency has arranged FREE TAX CLINICS, who help deserving Canadians in preparation of their Income Tax Returns free of charges – without any payment. These CLINICS operate in various Community Centres across the country. Those who require services for preparation of their Income Tax Returns, they should contact nearest Community Centre, get the required information and then get the appointment date in order to compete their Income Tax Returns.

Canada’s Tax Authority, CANADA REVENUE AGENCY has announced that those Canadian, who have no income, or who have little income not subject to tax, they should also file Income Tax Return in order to get various financial benefits for which they are eligible according to Canadian laws. These financial benefits include GST Credit, Canada Carbon Rebate (formerly Climate Action Incentive), Trillium Benefits (for Ontario province only) etc.

In addition to the above, other financial benefits e.g. Child Benefits, Old Age Security, Guaranteed Income Supplement, Disability Benefits etc. are also payable with certain conditions.